Company's Goal

Our team’s belief is that by bringing intention and alignment to your insurance planning while introducing you to an expert in your area is the proper way of doing business. With almost 20 years of experience in this industry, there isn’t a family we can’t help!

Why work with IA ?

- Education First

- Best Rates Available in your state

- Online Application process

- Dynamic team of experts

- Flexible Coverage options

Term vs Whole Life Insurance

Use this information to help you:

Learn about the differences in insurance.

Understand how it would help protect your family.

Compare it to your current coverage.

Questions?

Fill out the survey below for a time to speak!

Ready to get started ?

Prices from the Top Rated Insurance Carriers in the Country!

Individual Coverage Vs Group Insurance

Buying individual term insurance instead of or in addition to group life insurance allows you the following benefits :

A life insurance professional can help you determine how much insurance is the right amount and affordable for your current lifestyle.

Control over your coverage: You own the policy, so you control your coverage if you lose or change jobs, not your employer.

Price-Stability in price is so paramount later in life when things may change and the price of insurance can increase. When you lock in a rate now, it is stable for that length of time no matter the situation.

Many people buy additional life insurance through their employer because it is easy and convenient. Most people do not realize that purchasing individual term life insurance on their own may be a better option than buying additional group coverage at work. Here are some reasons why :

Limited Coverage: Group term insurance is usually 2-3 times your annual salary. What if that just isn't enough ?

Lack of portability: Changing jobs, being laid off, or leaving your job for an extended period of time may cause your coverage to change when you need it the most!

Price-group rates are not guaranteed and can increase over time.

Variable / Universal Life Insurance

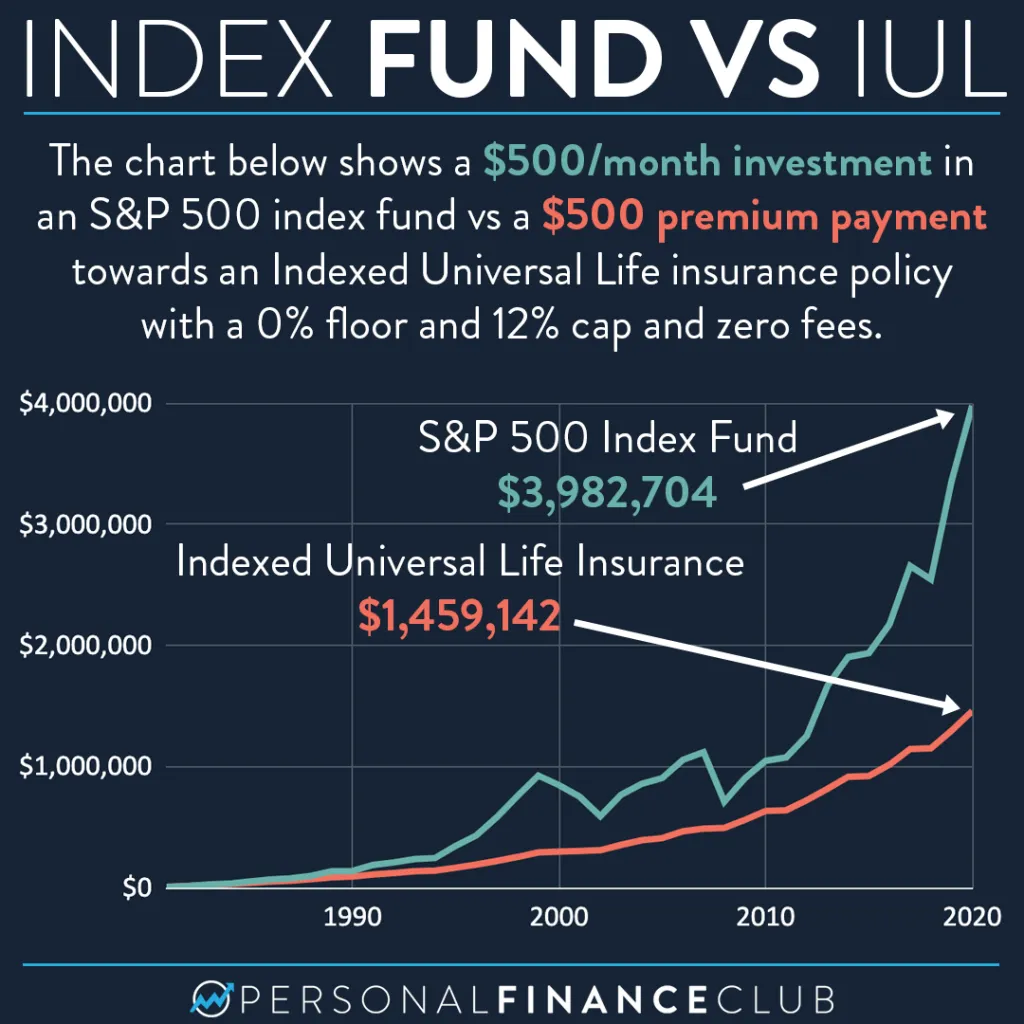

Variable and universal life insurance are both types of permanent life insurance that last for life and include a cash value component. However, the two types of policies differ in how the cash value functions. The cash value in variable life insurance has investment options and works like a mutual fund. Meanwhile, the cash value in universal life insurance grows based on the interest rate set by the insurer.

If you’re choosing between a variable or universal life insurance policy, talking to an expert about what works best for your financial strategy is very important. Even though they both have a cash value component, they grow differently, and the policy you decide on will impact your financial portfolio.

You also don’t have as much control over your investments in a cash value life insurance policy as you would with traditional investments, like stocks and mutual funds. These options should really only be utilized if you have maxed out other investments. Most people should simply get a traditional term life insurance policy and invest the difference.

Below is some information on using insurance as an investment tool and some of its outcomes.

Survey below to setup time to speak

By submitting this request, I agree to receive calls, texts or prerecorded messages from or on behalf of AAA Life Insurance Company or AAA partner companies, clubs, agencies, subsidiaries, affiliates or authorized representatives(full list of entities), at the phone number provided above, including my wireless number if provided. I understand that these calls, texts or prerecorded messages may be generated by automated technology including an automatic telephone dialing system and that consent is not required to make a purchase.